|

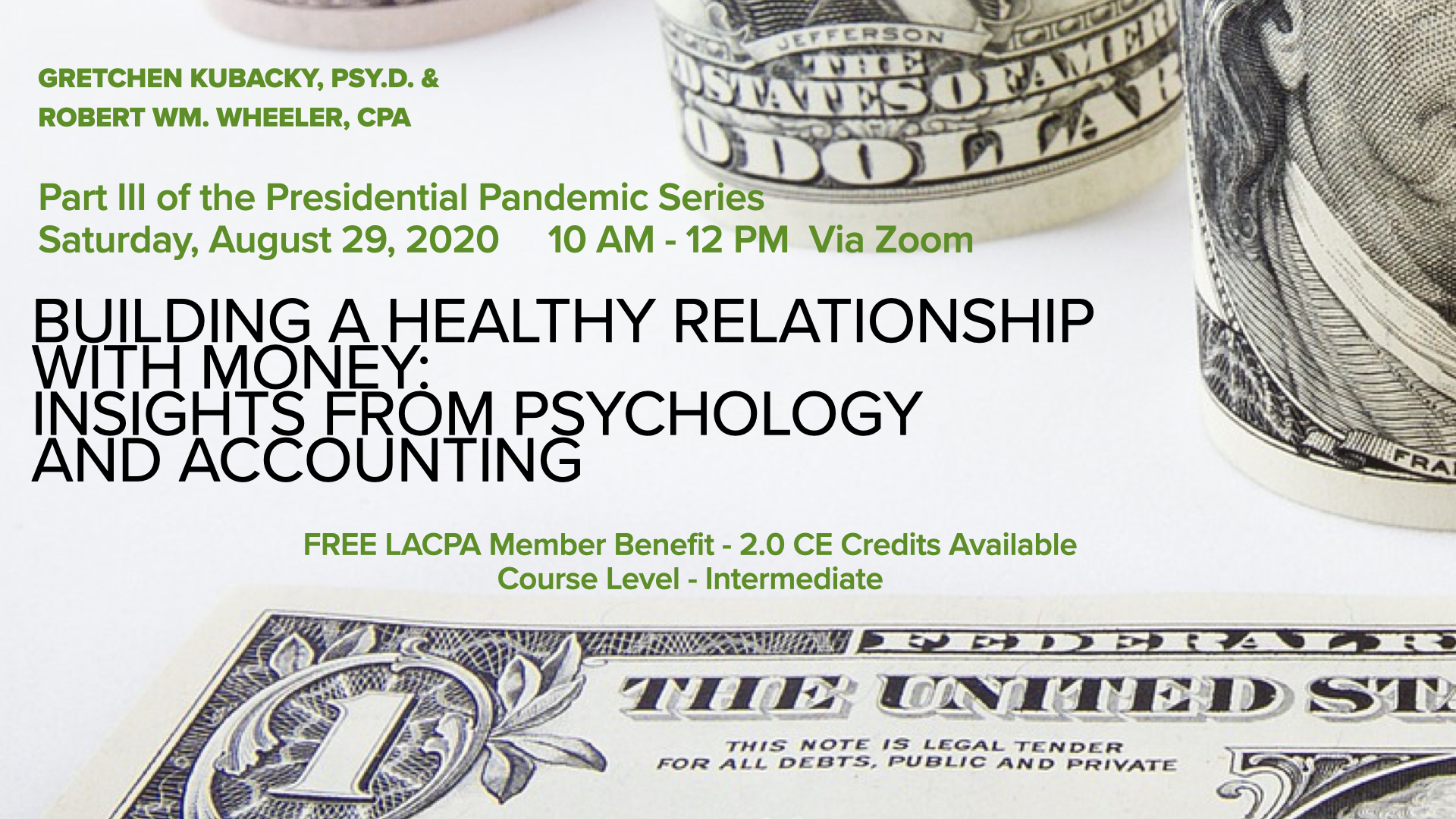

Virtual 8/29/20 Part III Pandemic Series - Relationship With Money

Saturday, August 29, 2020, 10:00 AM - 12:00 PM PDT

Category: Continuing Education Event

Registration closes 8/28/20. The coronavirus pandemic has resulted in vast and unanticipated economic changes to business operations, employment, and the stock market. Changes in social functioning, elevated stress, and direct economic losses affect psychotherapy processes and clients, as well as psychotherapists themselves. Psychologists need to provide hope and guidance to our clients while experiencing our own financial shifts. Psychologists will receive an overview of financial therapy theory and practice, the emotions of money, and recommendations for incorporating money discussions into psychotherapy effectively. In addition to a loss of health and life, COVID-19 has created a cascade of job loss (and related loss of insurance), business loss, increases to the cost of goods and services, and financial loss, ultimately leading to a recession and a 24.7% unemployment rate in Los Angeles. Financial stressors are, more than ever, a critical component of mental health and wellness. Despite this, we may find ourselves dealing with clients who appear to be unscathed by these changes. This presentation will help you feel more confident in your skills and knowledge about working with money issues in psychotherapy. We will address money scarcity, fear, anxiety, relationship money styles, money narratives, and cultural/familial money histories. We all have unique experiences with money, yet there are common themes and patterns in how our relationship with money affects our interpersonal relationships. Money is an often overlooked topic in psychotherapy (other than to address the issue of fees), yet it is an inescapable facet of daily life. There is tremendous opportunity to use what is happening in a client’s money relationship to explore wounds and biases, and facilitate growth and change, particularly as it relates to our beliefs about health, safety, and security. Clinicians will also benefit through doing the same work on themselves, becoming more comfortable with their own beliefs and behaviors, and how they may play out in psychotherapy. By candidly addressing this essential component of life, clients will develop a healthier relationship with money, and experience growth and meaning-making out of their experiences. The tools and approaches are compatible with any theoretical orientation.

Gretchen Kubacky, Psy.D. is a health psychologist and certified bereavement facilitator. She works with chronic illness, grief and loss, medical trauma, and health anxiety. She is the author of Moving Through Grief: Proven Techniques for Finding Your Way After Any Loss and The PCOS Mood Cure: Your Guide to Ending the Emotional Roller Coaster. Dr. Kubacky is the Editor of The Los Angeles Psychologist, and a member of the LACPA Board of Directors.

Robert Wm. Wheeler, CPA is an accountant, author, speaker, and host of the “Money You Should Ask” podcast. He is the author of The Money Nerve: Navigating the Emotions of Money, and frequently leads workshops on the emotions of money. He is also a CORE Energetics and Radical Aliveness Practitioner. His passion is helping others gain insight into how and why their emotions trigger financial decisions. He is also the CFO for The Comedy Store in West Hollywood and La Jolla, California. He is noted for his warmth, humor, and ability to inspire and motivate the most money-phobic clients.

Attendees will be able to: 1) Demonstrate knowledge of the psychological effects of poverty and debt. Schedule of the Program: 5 minutes - Introduction/housekeeping by a LACPA representative

The Los Angeles County Psychological Association (LACPA) is approved by the American Psychological Association to sponsor continuing education for psychologists. LACPA maintains responsibility for this program and its content. This presentation may be taken to satisfy the California Board of Behavioral Sciences (BBS) continuing education requirements. It is important to note that APA continuing education rules require that LACPA only give credit to those who attend the entire presentation. An evaluation of the presentation must be completed. Those who arrive more than 15 minutes after the scheduled start time or leave before the session is complete will not receive CE credit. Partial credit may not be given. Program is subject to change. Contact: LACPA at [email protected] or 818-905-0410 |

Prev Month

Prev Month View Month

View Month Search

Search Go to Month

Go to Month Next Month

Next Month

Export Event

Export Event